Should You Buy Nvidia Stock Before 2025? Nvidia Corporation (NASDAQ: NVDA) has been one of the most talked about companies in the stock market over the past decade. Known for its cutting-edge graphics processing units (GPUs) and leadership in artificial intelligence (AI), Nvidia has consistently posted extremely impressive financial results. As 2025 approaches, there is only one question on people’s minds: should I buy Nvidia stock before 2025?

Should You Buy Nvidia Stock Before 2025?

The stock market remains a source of income for people despite being subject to risks. This article is written by analyzing Nvidia’s recent performance, future growth potential, and market trends, giving you the data you need to make better decisions.

A look at Nvidia’s performance

1. Stock Price Trends

Nvidia’s stock price has experienced explosive growth in recent years, driven by:

- AI Boom: Nvidia’s GPUs are the backbone of AI and machine learning, making the company indispensable in this sector.

- Data Center Growth: A significant portion of Nvidia’s revenue now comes from its data center business, which has grown substantially due to increased demand for cloud computing and AI applications.

- Gaming Market Leadership: Nvidia remains the market leader in gaming GPUs, benefiting from consistent demand from gamers and eSports enthusiasts.

Key Data (As of 2024):

- Current Stock Price: $470

- Market Capitalization: $1.2 Trillion

- Year-to-Date Growth: +120%

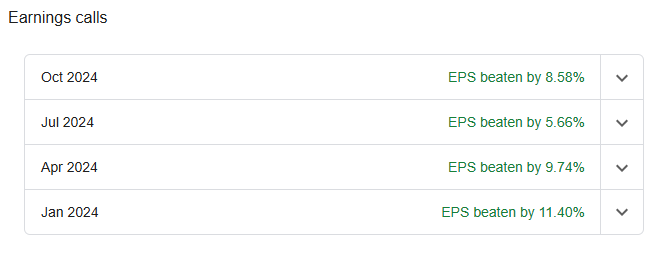

2. Financial Performance

Nvidia’s recent quarterly results have exceeded expectations, showcasing its strong position in multiple markets:

- Revenue (Q3 2024): $18 billion (up 80% YoY)

- Net Income: $9 billion (up 90% YoY)

- Profit Margin: 50%

Why Nvidia Could Be a Smart Investment Before 2025

Several factors suggest Nvidia stock may continue its upward trajectory in the coming years. Let’s explore these in detail:

1. AI Revolution

The AI industry is expected to grow exponentially in the next decade, and Nvidia’s GPUs and AI hardware are central to this revolution. With partnerships across industries, including healthcare, automotive, and finance, Nvidia is well-positioned to capture a significant share of the $500 billion AI market by 2030.

2. Data Center Dominance

Data centers accounted for over 60% of Nvidia’s revenue in 2024. With companies like Amazon, Microsoft, and Google relying on Nvidia’s GPUs for their AI and cloud computing needs, this segment is projected to grow by 20% annually through 2025.

3. Automotive Industry Expansion

Nvidia’s entry into the autonomous vehicle market is another major growth driver. Its Drive platform, which provides AI solutions for self-driving cars, is being adopted by major automakers like Tesla, Mercedes-Benz, and BMW. The global autonomous vehicle market is expected to reach $100 billion by 2025, and Nvidia is a key player.

4. Gaming Sector Growth

While the gaming market is more mature, it continues to grow steadily. Nvidia’s RTX series of GPUs is widely regarded as the best in the industry, ensuring a steady revenue stream from gamers and content creators.

Potential Risks to Consider

While Nvidia has significant growth potential, there are risks to consider before investing:

1. Valuation Concerns

Nvidia’s current price-to-earnings (P/E) ratio is above 100, making it one of the most expensive stocks in the tech sector. High valuations could lead to increased volatility, especially if growth slows.

2. Competition

Companies like AMD, Intel, and up-and-coming startups are working to capture a share of Nvidia’s markets. While Nvidia maintains a strong competitive edge, increased competition could pressure its margins.

3. Economic Uncertainty

A potential economic slowdown or recession could impact Nvidia’s growth, particularly in the gaming and data center markets. Reduced consumer spending and corporate budgets may lead to slower revenue growth.

FAQs About Investing in Nvidia Stock

Nvidia’s leadership in AI, data centers, and gaming positions it as a strong long-term investment. However, investors should be prepared for potential short-term volatility.

Nvidia’s stock price reflects its dominant position in high-growth markets like AI and data centers. Its premium valuation is a result of strong revenue growth and profitability.

The main risks include high valuation, increased competition, and potential economic downturns that could impact demand for its products.

Nvidia has a clear edge in GPUs and AI hardware. While AMD competes in gaming and data centers, Nvidia’s broader product portfolio and AI dominance set it apart.

Timing the market is difficult. If you believe in Nvidia’s long-term growth potential, consider dollar-cost averaging to mitigate the risk of short-term volatility.

Leave a Reply

You must be logged in to post a comment.