Managing your finances efficiently is crucial in 2025, and monthly budget templates & tools can help you track expenses, save money, and achieve financial stability. Whether you are a student, working professional, or business owner, using the right budgeting tools ensures better money management. This guide explores top budgeting templates and tools in 2025, their features, benefits, and how to choose the best one for your needs.

Why Use Budgeting Templates & Tools in 2025?

- Automated tracking of income and expenses.

- Better financial planning with goal-setting features.

- Improves savings habits and reduces unnecessary spending.

- Ensures timely bill payments with reminders and alerts.

- Helps in debt management by allocating funds effectively.

Types of Monthly Budget Templates & Tools in 2025

Budget templates help users create structured spending plans. Here are some popular types:

1. Excel & Google Sheets Budget Templates

- Customizable for different financial goals.

- Uses formulas and graphs for automatic calculations.

- Free and easy to use for personal and business budgeting.

2. Printable Budget Templates (PDF)

- Best for users who prefer manual tracking.

- Easy to print and use offline.

- Includes weekly, bi-weekly, and monthly tracking options.

3. App-Based Budget Templates

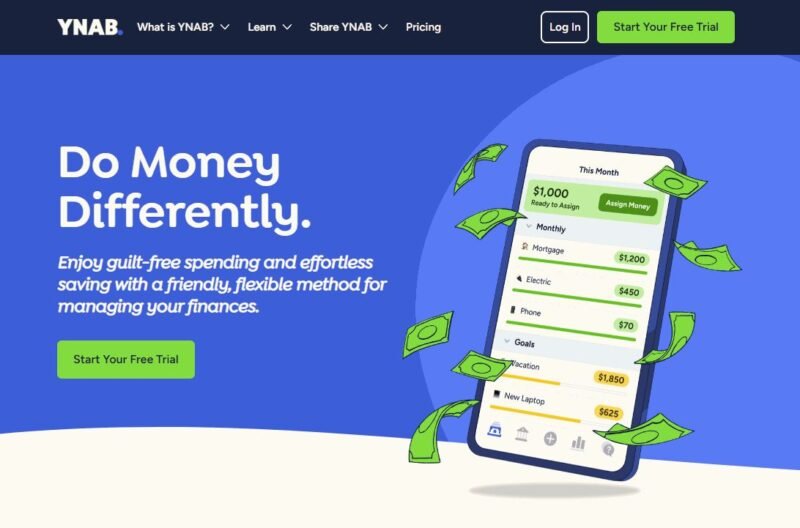

- Available in popular budgeting apps like Mint, YNAB, and PocketGuard.

- Syncs with bank accounts for real-time updates.

- AI-driven spending insights for better decisions.

Best Monthly Budgeting Tools in 2025

Here are some of the best budgeting tools in 2025 for personal and business use:

| Tool Name | Best For | Features | Pricing |

|---|---|---|---|

| Mint | Beginners | Expense tracking, bill reminders, financial reports | Free |

| YNAB (You Need A Budget) | Advanced Budgeting | Zero-based budgeting, debt payoff strategy | $14.99/month |

| PocketGuard | Overspending Control | Bank sync, expense categorization, bill negotiation | Free & Paid Plans |

| GoodBudget | Manual Budgeting | Envelope budgeting system | Free & $7/month |

| EveryDollar | Personal Finance | Zero-based budgeting, goal tracking | Free & Paid Plans |

How to Choose the Best Budgeting Template or Tool in 2025

- Assess your financial goals (Savings, debt management, investments).

- Consider ease of use (Manual vs. automated tracking).

- Check integration features (Bank sync, reminders, reports).

- Compare free vs. paid plans for affordability.

- Read reviews and ratings before selecting a tool.

How to Create a Monthly Budget in 2025

Step 1: List Your Income Sources

- Salary

- Freelance earnings

- Rental income

- Investments

Step 2: Categorize Your Expenses

- Fixed Expenses (Rent, loans, insurance)

- Variable Expenses (Food, shopping, entertainment)

- Savings & Investments

Step 3: Allocate Funds Using 50/30/20 Rule

- 50% for Needs (Rent, bills, groceries)

- 30% for Wants (Dining out, shopping, entertainment)

- 20% for Savings & Debt Repayment

Step 4: Track & Adjust Your Budget

- Use an Excel sheet, printable template, or app.

- Review spending weekly or monthly.

- Adjust expenses based on financial goals.

Benefits of Using Monthly Budgeting Tools in 2025

- Real-time tracking to avoid overspending.

- Data insights for better financial planning.

- Automation reduces manual effort.

- Security features protect financial data.

FAQs: Monthly Budget Templates & Tools in 2025

Mint and PocketGuard offer excellent free budgeting features for beginners.

GoodBudget and YNAB provide shared budget options for couples.

Yes, Google Sheets templates are customizable and free to use.

Yes, most budgeting apps use encryption and multi-factor authentication for security.

Leave a Reply

You must be logged in to post a comment.