Understanding the nuances of income tax is essential, especially when it comes to older citizens. The Indian Income Tax Act provides several benefits to older citizens, such as higher exemption limits and reduced tax rates. However, availing of these benefits requires accurately determining whether a taxpayer qualifies as an older citizen or a super older citizen. In this guide, we’ll explain how to calculate the age of an older citizen for income tax purposes and why it’s important, along with other useful insights to optimize your tax savings.

Who Qualifies as an older citizen or a Super older citizen?

Under the Income Tax Act, there are two age-based categories for older citizens:

- Older citizen:

Any individual who is 60 years or older but less than 80 years of age at any time during the financial year. - Super older citizen:

Any individual who is 80 years or older at any time during the financial year.

The age of the individual is calculated as of the last day of the financial year (March 31). This distinction is critical because both categories are entitled to separate tax benefits.

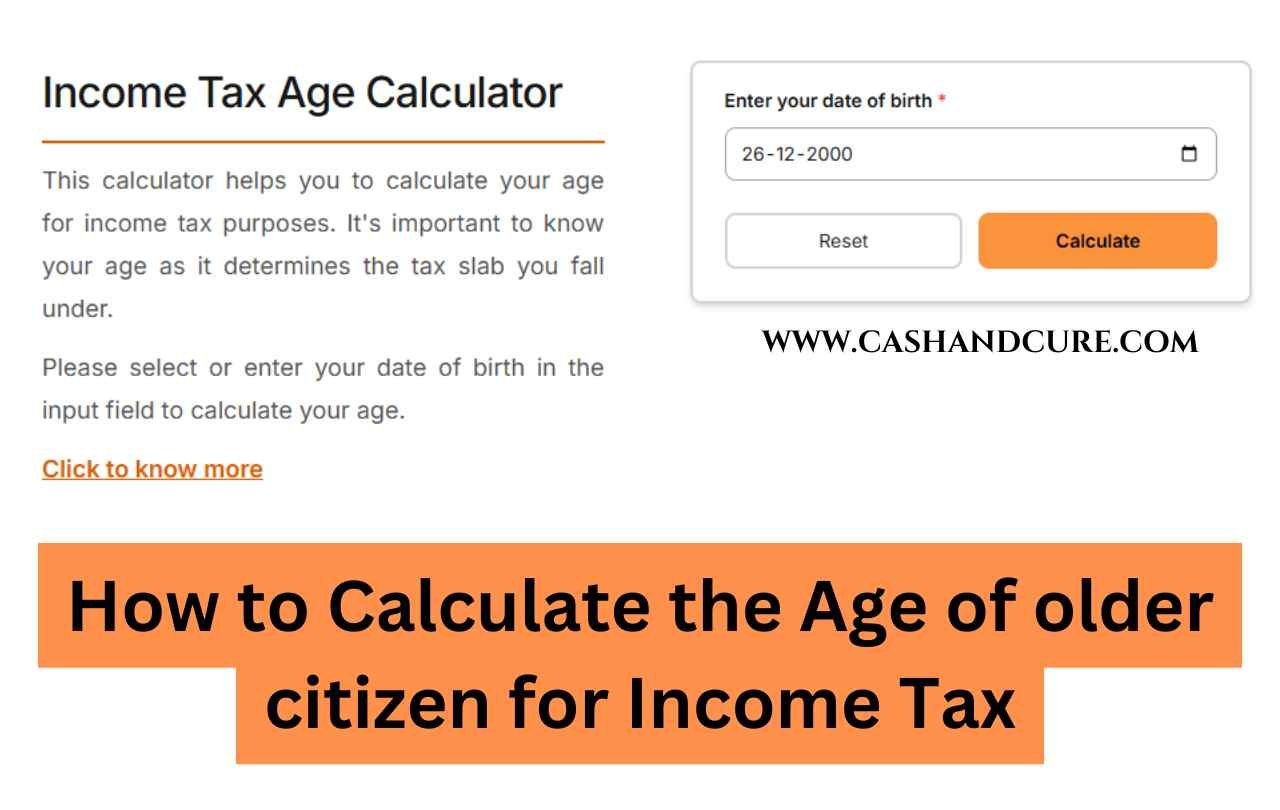

How to Calculate the Age of an Older Citizen for Income Tax

To determine if someone qualifies as an older citizen or a super older citizen, their date of birth is the key factor.

Step-by-Step Calculation:

- Obtain the Date of Birth:

Verify the taxpayer’s date of birth through official documents like Aadhaar, PAN card, or passport. - Determine the Financial Year:

Identify the financial year for which the income tax return is being filed. For example, if the return is for FY 2024-25, the relevant date is March 31, 2025. - Calculate the Age:

Subtract the birth year from the financial year’s end year (e.g., 2025 – Birth Year). Consider whether the taxpayer’s birthday falls before or after March 31 of the financial year:- If the birthday is on or before March 31, the individual’s age is considered completed for that financial year.

- If the birthday is after March 31, they have not yet completed that age.

Example:

If a taxpayer was born on February 28, 1965, their age on March 31, 2025, will be:

2025 – 1965 = 60 years.

Since their 60th birthday falls before March 31, 2025, they qualify as an older citizen for FY 2024-25.

On the other hand, if the taxpayer was born on April 2, 1965, they will turn 60 after the financial year ends and won’t qualify as an older citizen for that year.

Tax Benefits for Older and Super Older Citizens

Once you determine an individual’s eligibility, they can avail themselves of various tax benefits.

1. Higher Basic Exemption Limits:

- For Older citizens: The basic exemption limit is Rs.3 lakh, compared to Rs.2.5 lakh for individuals below 60.

- For super Older citizens: The basic exemption limit is Rs.5 lakh.

2. No Advance Tax Payment:

Older citizens not having business income are exempt from paying advance tax. They can pay their entire tax liability as self-assessment tax by the due date of filing the ITR.

3. Deductions Under Section 80D:

- Older citizens can claim a higher deduction of up to Rs.50,000 for health insurance premiums.

- Expenses incurred for medical treatment of Older citizens (if no insurance is purchased) are also deductible.

4. Exemption on Interest Income:

Under Section 80TTB, Older citizens can claim a deduction of up to Rs.50,000 on interest earned from savings accounts, fixed deposits, or recurring deposits.

Documents Needed to Verify Age for Income Tax

To ensure smooth filing and eligibility, taxpayers must submit valid documents as proof of age.

- Aadhaar Card

- PAN Card

- Passport

- Voter ID

- Birth Certificate

- Pension Payment Order (if applicable)

Ensure that the document contains the exact date of birth to avoid discrepancies during verification.

Common Mistakes to Avoid

- Incorrect Date of Birth:

Always cross-check the date of birth entered in the ITR form with official documents. Even a minor error can result in the denial of older citizen benefits. - Misinterpreting Financial Years:

Many taxpayers confuse the financial year with the assessment year. Ensure the age calculation is aligned with the correct financial year. - Not Updating Age in Records:

If your age records are not updated with your bank or the Income Tax Department, it could delay or deny your tax benefits. - Missing Proof of Age:

Always retain a copy of your proof of age when claiming older citizen benefits.

Importance of Calculating Age Accurately

Accurate age calculation is crucial for the following reasons:

- Ensures eligibility for higher tax exemptions and deductions.

- Helps avoid penalties or notices from the Income Tax Department.

- Simplifies tax filing by ensuring accurate categorization of taxpayers.

Optimizing Tax Savings for Older Citizens

Apart from basic exemptions, Older citizens can optimize their tax savings through strategic planning:

- Invest in Tax-Saving Schemes:

- Older Citizens’ Saving Scheme (SCSS): Offers a high interest rate of around 7%-8% with a five-year lock-in period.

- Tax-saving fixed deposits: Deduction of up to Rs.1.5 lakh under Section 80C.

- Leverage Section 80D Benefits:

Ensure to claim health insurance premium deductions or medical expenses incurred during the financial year. - Maximize Section 80TTB Deductions:

Park surplus funds in bank fixed deposits or post office savings schemes to earn interest income eligible for deduction. - Avoid Tax Deducted at Source (TDS):

Submit Form 15H to your bank if your total income is below the taxable limit to prevent TDS on interest income.

Leave a Reply

You must be logged in to post a comment.